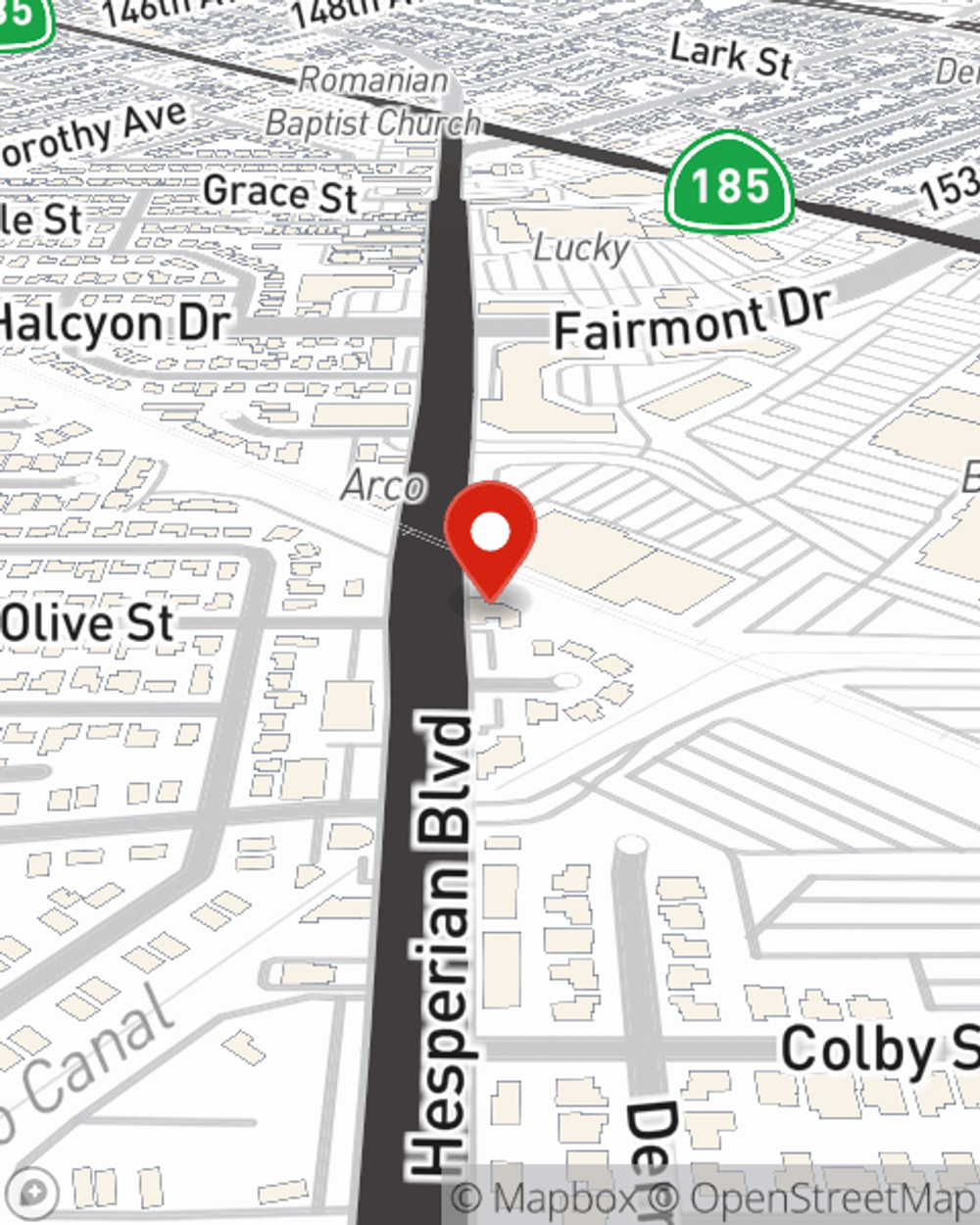

Business Insurance in and around San Leandro

San Leandro! Look no further for small business insurance.

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected accident or mishap. And you also want to care for any staff and customers who become injured on your property.

San Leandro! Look no further for small business insurance.

Almost 100 years of helping small businesses

Strictly Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Ed Spijker is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Ed Spijker can help you file your claim. Keep your business protected and growing strong with State Farm!

So, take the responsible next step for your business and visit with State Farm agent Ed Spijker to discover your small business insurance options!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Ed Spijker

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.